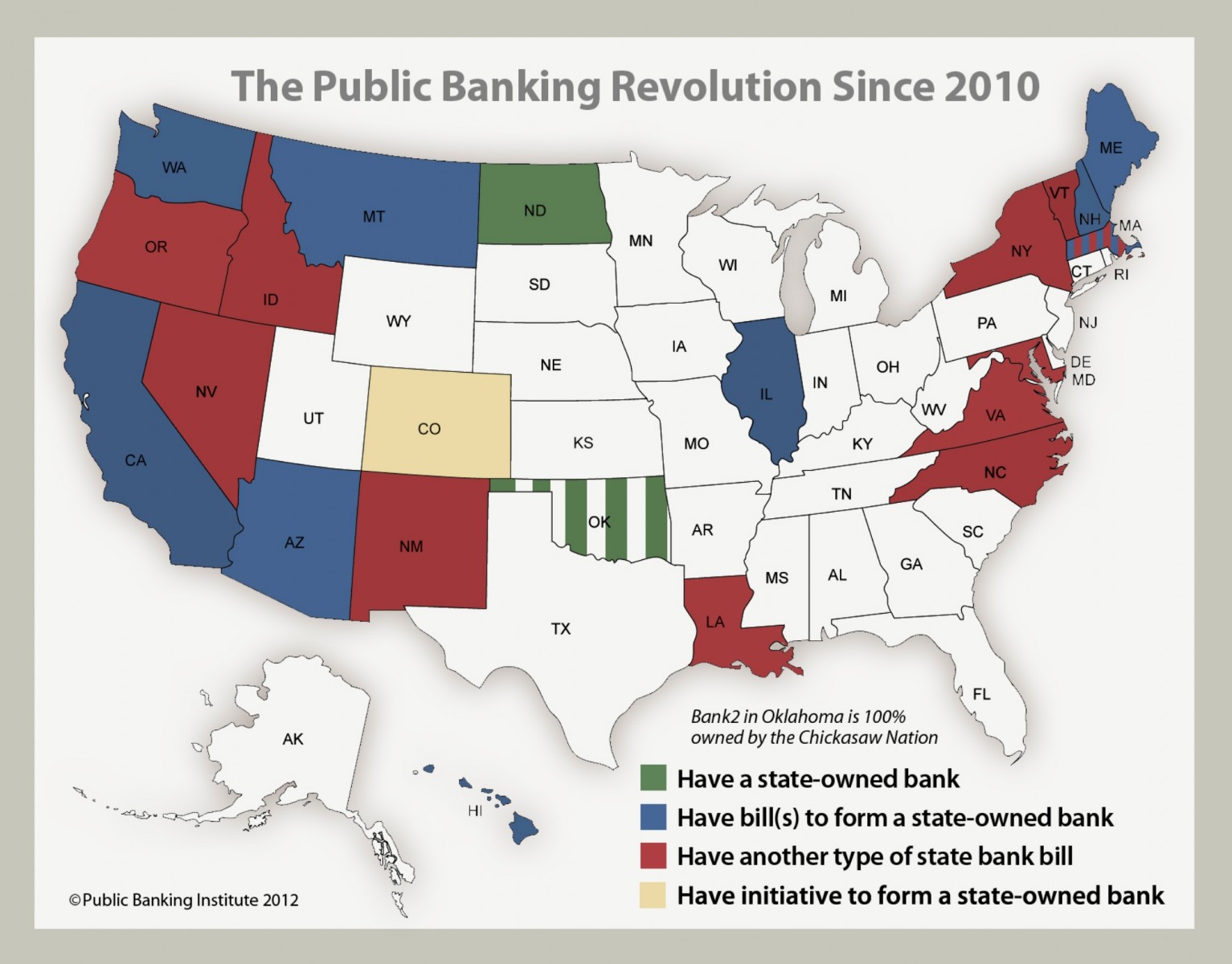

Legislation for State-Owned Banks

Legislation for State-Owned Banks

| State | Year | Legislation |

|---|---|---|

| Arizona | ||

| 2011 | H.B. 2221 (2011) Creates the Bank of Arizona and establishes duties of the Bank of Arizona Commission and Board of Directors | |

| 2012 | H.B. 2104 (2012) Establishes the Bank of Arizona and outlines the duties of the Bank of Arizona Commission and board of directors. | |

| California | ||

| 2011 | A.B. 750 (2011) Vetoed by governor 9/26/11 This bill establishes the investment trust blue ribbon task force to consider the viability of establishing the California Investment Trust, which would be a state bank receiving deposits of state funds. |

|

| 2012 | A.B. 2500 (2012) This bill establishes the California Investment Trust within state government, and authorizes the trust to exercise various powers and duties relating to banking, including, among others, receiving and managing deposits from public funds, loaning money, engaging in financial transactions, and buying and selling federal funds. The bill requires all state money, as defined, to be deposited into the California Investment Trust. The bill establishes a California Investment Trust Board to be chaired by the treasurer, and establishes an advisory board for purposes of advising the board. | |

| Hawaii | ||

| 2010 | H.C.R. 200 (2010) Passed House 4/9/10. Requests the Legislative Reference Bureau to study the feasibility of establishing a state-owned bank. | |

| 2011 | H.B. 853 (2011)

Passed House 3/8/11.

Establishes a task force to review, investigate and study the feasibility and cost of establishing the bank of the state of Hawaii. Requires reports to the Legislature.

H.C.R. 159 (2011) Passed House 4/15/11. H.R. 139 (2011) Adopted 4/15/11. Creates the task force on establishing the bank of the state of Hawaii. S.B. 194 (2011) Establishes the state bank of Hawaii for the purpose of promoting agriculture, education, community development, economic development, commerce, and industry within the state. |

|

| 2012 | H.B. 1840 (2012)

Passed House 3/6/12.

Establishes a task force to review, investigate, and study the feasibility and cost of establishing a state-owned bank. Requires a report to the Legislature.

H.B. 2103 (2012) Passed House 3/6/12. Directs the Department of Commerce and Consumer Affairs to conduct a comprehensive review of relevant state laws to develop legislation to establish the bank of the State of Hawaii. Appropriates funds to conduct the review. Directs the Hawaii housing and finance and development corporation to establish and operate an interim purchase program for distressed residential properties encumbered by problematic mortgages until the bank of the state of Hawaii is operational. Establishes minimum percentages of state funds that shall be deposited in the bank of the state of Hawaii. |

|

| 2015 | H.B. 326 (2015) Directs DCCA to conduct a comprehensive review of relevant state laws to develop legislation to establish the bank of the State of Hawaii. Appropriates funds to conduct the review. Directs the HHFDC to establish and operate an interim purchase program for distressed residential properties encumbered by problematic mortgages until the bank of the State of Hawaii is operational. Establishes minimum percentages of state funds that shall be deposited in the bank of the State of Hawaii. | |

| Illinois | ||

| 2010 | H.B. 5476 (2010) Creates the Community Bank of Illinois Act. Provides that the Department of Financial and Professional Regulation shall operate the Community Bank of Illinois. Specifies the authority of the advisory board of directors to the Bank. Provides that the secretary is to employ a president and employees. Contains provisions concerning the removal and discharge of appointees. Provides that state funds must be deposited in the Bank. | |

| 2011 | H.B. 2064 (2011) Creates the Community Bank of Illinois Act. | |

| 2012 | H.B. 2064 (2012)

Creates the Community Bank of Illinois Act. Provides that the Department of Financial and Professional Regulation shall operate the Community Bank of Illinois. Specifies the authority of the advisory board of directors to the Bank. Provides that the secretary is to employ a president and employees. Contains provisions concerning the removal and discharge of appointees. Provides that state funds must be deposited in the Bank.

H.B. 5010 (2012) Creates the State Bank of Illinois Act. Establishes the State Bank of Illinois and the State Bank of Illinois Board. Sets forth the membership of the state board. Provides that the state board shall appoint an advisory board of directors. Provides that the State Bank may accept deposits of private funds and public funds. |

|

| Louisiana | ||

| 2010 | H.C.R. 111 (2010) |

|

| 2011 | H.C.R. 144 (2011) |

|

| Maryland | ||

| 2011 | H.B. 1066 (2011) Establishes the Maryland State Bank Commission to review and evaluate the creation of a Maryland State Bank; provides for the membership and staffing of the Commission; prohibits members of the Commission from receiving specified compensation, but authorizes the reimbursement of specified expenses; requires a final report by a specified date.

S.B. 789 (2011) Establishes the Maryland State Bank Commission to review and evaluate the creation of a Maryland State Bank; provides for the membership and staffing of the Commission; prohibits members of the Commission from receiving specified compensation, but authorizes the reimbursement of specified expenses; requires a final report by a specified date. |

|

| 2012 | H.B. 1258 (2012) Establishes the Maryland State Bank Task Force to review and evaluate the creation of a Maryland State Bank; provides for the membership and staffing of the task force; prohibits members of the task force from receiving specified compensation, but authorizes the reimbursement of specified expenses; requires a final report by December 1, 2012; provides for the termination of the Act. | |

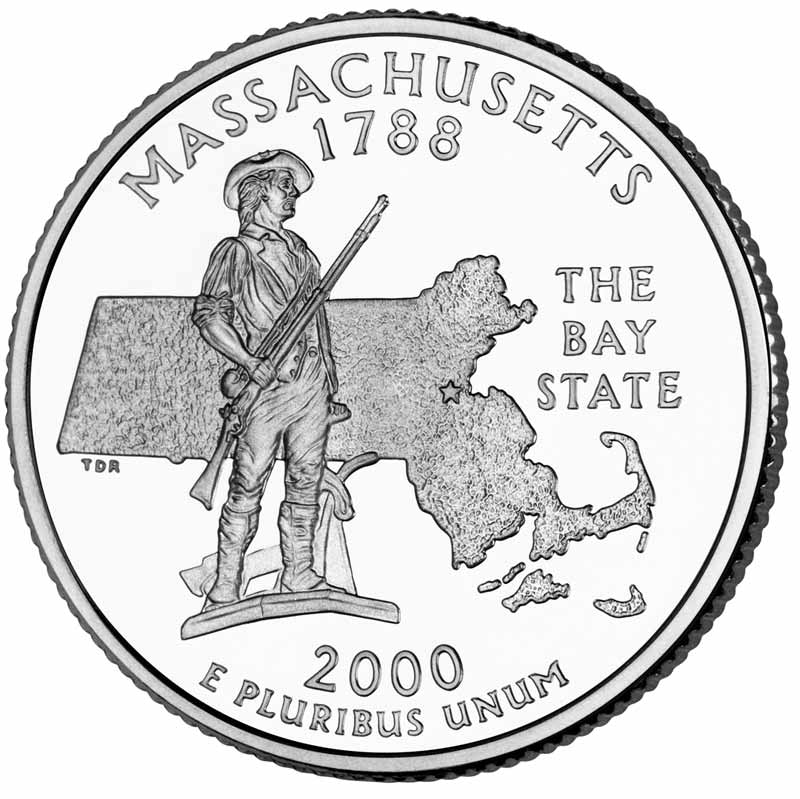

| Massachusetts | ||

| 2010 | S.B. 2270 (2010)

Accompanied by new draft S.B. 2331 3/18/10.

Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth.

S.B. 2331 (2010) Accompanied by new draft S.B. 2345 4/1/10. Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth. S.B. 2345 (2010) Accompanied by new draft S.B. 2380 4/8/10. Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth. S.B. 2380 (2010) Substituted by S.B. 2582 7/30/10. Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth. S.B. 2582 (2010) Signed by governor with line item veto 8/5/10. Veto Message: Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth. |

|

| 2011 | H.C.R. 144 (2011) |

|

| Virginia | ||

| 2010 | H.J.R. 62 (2010) Establishes a joint subcommittee to study whether to establish a bank operated by the Commonwealth. The study shall consider recommendations for legislation to establish a state owned, controlled, and operated bank. | |

| Washington | ||

| 2011 | H.B. 3162 Creates a state bank overseen by the state treasurer. Allows the state treasurer to fund the bank with state funds. Provides the state bank with the same types of authority to operate as a private bank chartered by the state. | |

| 2011 | H.J.R. 4224 Proposes an amendment to the state constitution authorizing a state bank of Washington. | |

| California | ||

| 2011 |

-

-

Alaska

-

Arizona

Organization: Arizonans for a New Economy

Contact: James Hannley

Legislation Links:

H.B. 2104 (2012) Establishes the Bank of Arizona and outlines the duties of the Bank of Arizona Commission and board of directors.

H.B. 2221 (2011) Creates the Bank of Arizona and establishes duties of the Bank of Arizona Commission and Board of Directors.

-

Arkansas

-

California

Organization: Mendocino Public Banking Coalition

Contacts:

Los Angeles, CA: Ellen Brown

Mendocino, CA: Agnes Woolsey

San Diego, CA: Ian Mackenzie

Sonoma, CA: Jack Wagner

Legislation Links:

A.B. 2500 (2012) This bill establishes the California Investment Trust within state government, and authorizes the trust to exercise various powers and duties relating to banking, including, among others, receiving and managing deposits from public funds, loaning money, engaging in financial transactions, and buying and selling federal funds. The bill requires all state money, as defined, to be deposited into the California Investment Trust. The bill establishes a California Investment Trust Board to be chaired by the treasurer, and establishes an advisory board for purposes of advising the board.

A.B. 750 (2011) Vetoed by governor 9/26/11

This bill establishes the investment trust blue ribbon task force to consider the viability of establishing the California Investment Trust, which would be a state bank receiving deposits of state funds. The task force would be required to consider how the investment trust could strengthen economic and community development, provide financial stability to businesses, reduce the cost paid by state government for banking services, and provide for excess earnings of the trust to be used to supplement general fund purposes.

-

Colorado

-

Connecticut

-

Delaware

-

Florida

-

Georgia

-

Hawaii

Organization:

Contact:

Legislation Links:

H.B. 326 (2015) Directs DCCA to conduct a comprehensive review of relevant state laws to develop legislation to establish the bank of the State of Hawaii. Appropriates funds to conduct the review. Directs the HHFDC to establish and operate an interim purchase program for distressed residential properties encumbered by problematic mortgages until the bank of the State of Hawaii is operational. Establishes minimum percentages of state funds that shall be deposited in the bank of the State of Hawaii.

H.B. 1840 (2012) Passed House 3/6/12. Establishes a task force to review, investigate, and study the feasibility and cost of establishing a state-owned bank. Requires a report to the Legislature.

H.B. 2103 (2012) Passed House 3/6/12. Directs the Department of Commerce and Consumer Affairs to conduct a comprehensive review of relevant state laws to develop legislation to establish the bank of the State of Hawaii. Appropriates funds to conduct the review. Directs the Hawaii housing and finance and development corporation to establish and operate an interim purchase program for distressed residential properties encumbered by problematic mortgages until the bank of the state of Hawaii is operational. Establishes minimum percentages of state funds that shall be deposited in the bank of the state of Hawaii.

H.B. 853 (2011) Passed House 3/8/11. Establishes a task force to review, investigate and study the feasibility and cost of establishing the bank of the state of Hawaii. Requires reports to the Legislature.

H.C.R. 159 (2011) Passed House 4/15/11.

H.R. 139 (2011) Adopted 4/15/11. Creates the task force on establishing the bank of the state of Hawaii.

S.B. 194 (2011) Establishes the state bank of Hawaii for the purpose of promoting agriculture, education, community development, economic development, commerce, and industry within the state.

H.C.R. 200 (2010) Passed House 4/9/10. Requests the Legislative Reference Bureau to study the feasibility of establishing a state-owned bank. -

Idaho

-

Illinois

Organization:

Contact:

Legislation Links:

H.B. 2064 (2012) Creates the Community Bank of Illinois Act. Provides that the Department of Financial and Professional Regulation shall operate the Community Bank of Illinois. Specifies the authority of the advisory board of directors to the Bank. Provides that the secretary is to employ a president and employees. Contains provisions concerning the removal and discharge of appointees. Provides that state funds must be deposited in the Bank. Contains provisions concerning the nonliability of officers and sureties after deposit. Specifies the powers of the Bank. Contains provisions concerning the guaranty of deposits and the Bank's role as a clearinghouse, the authorization of loans the General Revenue Fund, bank loans to farmers, limitations on loans by the Bank, the name in which business is conducted and titles taken, civil actions, surety on appeal, audits, electronic fund transfer systems, confidentiality of bank records, the sale and leasing of acquired agricultural real estate, and the Illinois higher education savings plan. Provides that the Bank is the custodian of securities. Amends the Illinois State Auditing Act to require that the auditor general must contract with an independent certified public accounting firm for an annual audit of the Community Bank of Illinois as provided in the Community Bank of Illinois Act. Amends the Eminent Domain Act to allow the Bank to acquire property by eminent domain.

H.B. 5010 (2012) Creates the State Bank of Illinois Act. Establishes the State Bank of Illinois and the State Bank of Illinois Board. Sets forth the membership of the state board. Provides that the state board shall appoint an advisory board of directors. Provides that the State Bank may accept deposits of private funds and public funds. Sets forth the powers of the State Bank. Provides that all deposits in the State Bank are guaranteed by the state. Provides that, whenever any public funds are deposited into the State Bank, the public official who deposited the funds is exempt from liability for loss of the funds while they are deposited in the State Bank. Amends the Freedom of Information Act to provide that certain records of the State Bank are exempt from disclosure.

H.B. 2064 (2011) Creates the Community Bank of Illinois Act.

H.B. 5476 (2010) Creates the Community Bank of Illinois Act. Provides that the Department of Financial and Professional Regulation shall operate the Community Bank of Illinois. Specifies the authority of the advisory board of directors to the Bank. Provides that the secretary is to employ a president and employees. Contains provisions concerning the removal and discharge of appointees. Provides that state funds must be deposited in the Bank. Contains provisions concerning the nonliability of officers and sureties after deposit. Specifies the powers of the Bank. Contains provisions concerning the guaranty of deposits and the Bank's role as a clearinghouse, the authorization of loans the General Revenue Fund, bank loans to farmers, limitations on loans by the Bank, the name in which business is conducted and titles taken, civil actions, surety on appeal, audits, electronic fund transfer systems, confidentiality of bank records, the sale and leasing of acquired agricultural real estate, and the Illinois higher education savings plan. Provides that the Bank is the custodian of securities. Amends the Illinois State Auditing Act to require that the Auditor General must contract with an independent certified public accounting firm for an annual audit of the Community Bank of Illinois as provided in the Community Bank of Illinois Act. Amends the Eminent Domain Act to allow the Bank to acquire property by eminent domain. Provides that the Department of Financial and Professional Regulation may in turn direct the Community Bank of Illinois to make loans to the General Revenue Fund by the purchase of the evidences of indebtedness at those rates of interest as the Department may prescribe. -

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

Organization:

Contact:

Legislation Links:

H.C.R. 144 (2011) Passed House 6/2/11. Requests the state treasurer and the Office of Financial Institutions to jointly study the creation of a state-owned bank.

H.C.R. 111 (2010) Passed House 4/14/10. Requests the Office of Financial Institutions to study the creation of a state-owned bank. -

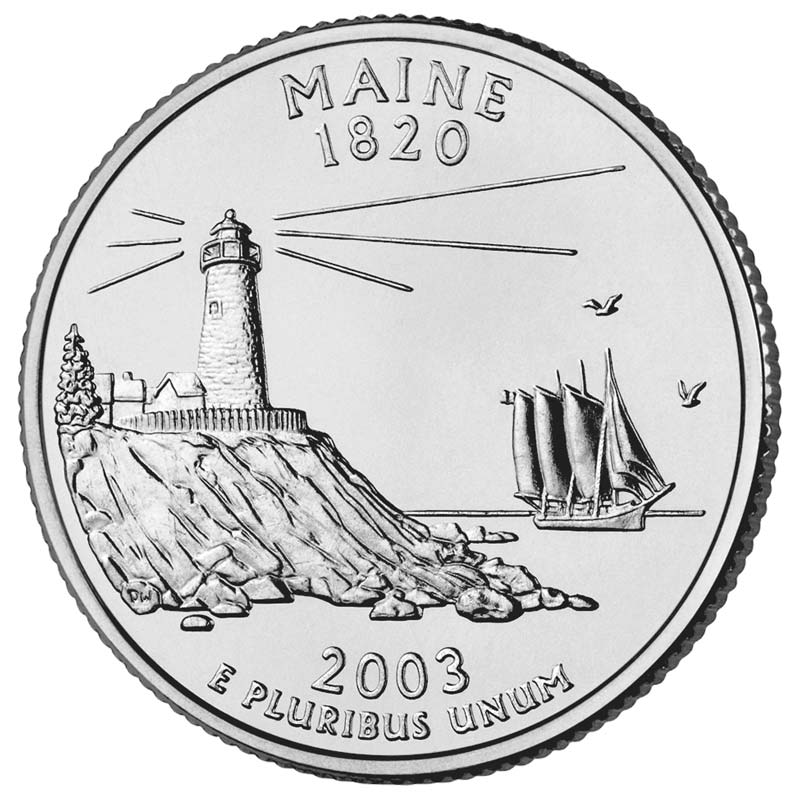

Maine

-

Maryland

Organization:

Contact:

Legislation Links:

H.B. 1258 (2012) Establishes the Maryland State Bank Task Force to review and evaluate the creation of a Maryland State Bank; provides for the membership and staffing of the task force; prohibits members of the task force from receiving specified compensation, but authorizes the reimbursement of specified expenses; requires a final report by December 1, 2012; provides for the termination of the Act.

H.B. 1066 (2011) Establishes the Maryland State Bank Commission to review and evaluate the creation of a Maryland State Bank; provides for the membership and staffing of the Commission; prohibits members of the Commission from receiving specified compensation, but authorizes the reimbursement of specified expenses; requires a final report by a specified date.

S.B. 789 (2011) Establishes the Maryland State Bank Commission to review and evaluate the creation of a Maryland State Bank; provides for the membership and staffing of the Commission; prohibits members of the Commission from receiving specified compensation, but authorizes the reimbursement of specified expenses; requires a final report by a specified date. -

Massachusetts

Organization:Hub Public Banking

Contact: Stephen Snyder

Legislation Links:

H.B. 1192 (2011) Creates the Bank of Massachusetts.

S.B. 2270 (2010) Accompanied by new draft S.B. 2331 3/18/10. Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth.

S.B. 2331 (2010) Accompanied by new draft S.B. 2345 4/1/10. Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth.

S.B. 2345 (2010) Accompanied by new draft S.B. 2380 4/8/10. Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth.

S.B. 2380 (2010) Substituted by S.B. 2582 7/30/10. Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth.

S.B. 2582 (2010) Signed by governor with line item veto 8/5/10. Veto Message: Establishes a commission to study the feasibility of establishing a bank owned by the commonwealth or by a public authority constituted by the commonwealth. -

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

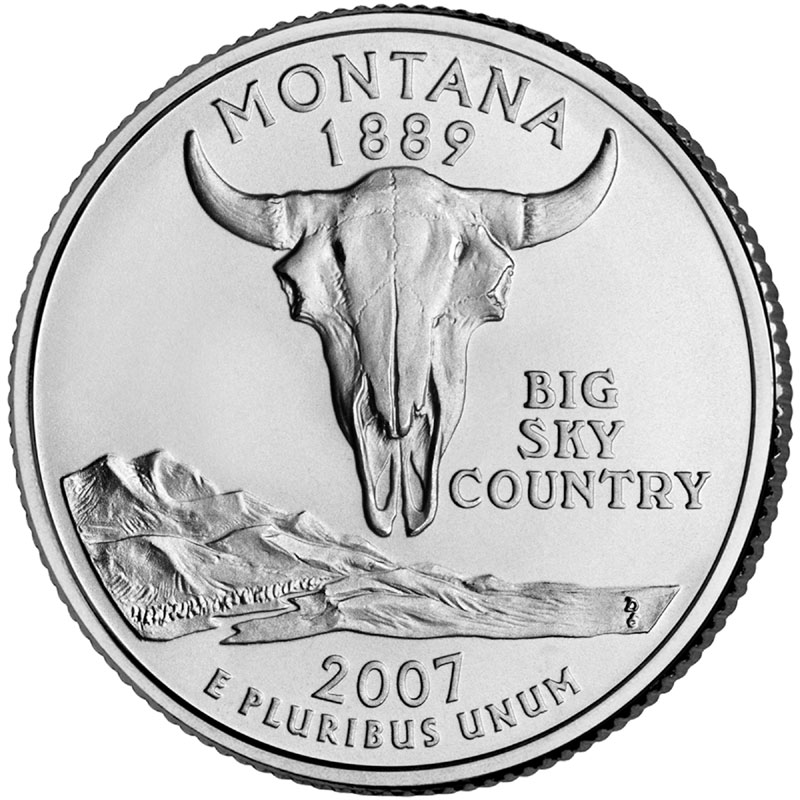

Montana

-

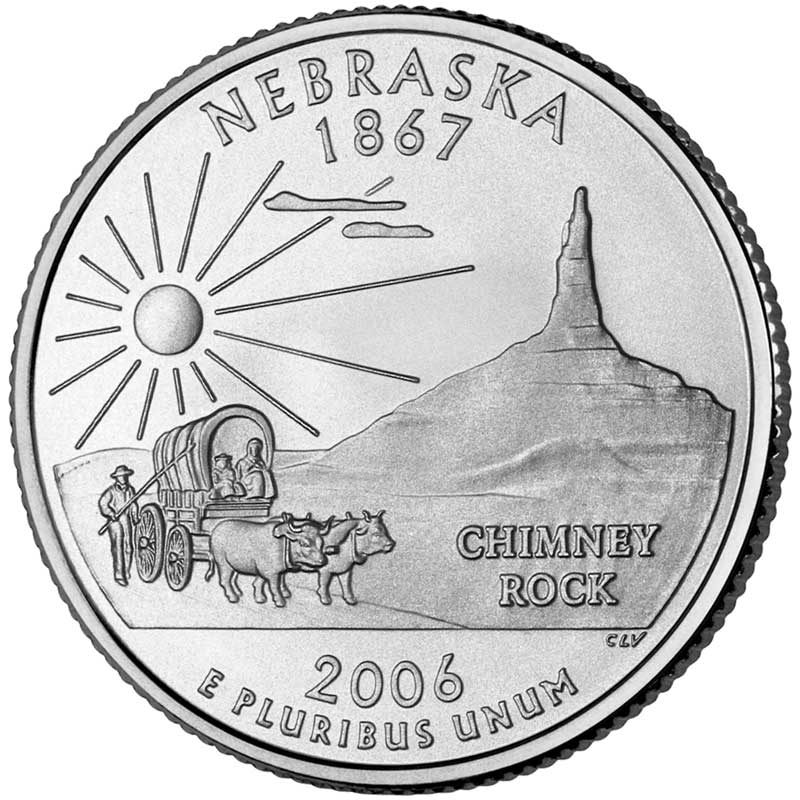

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

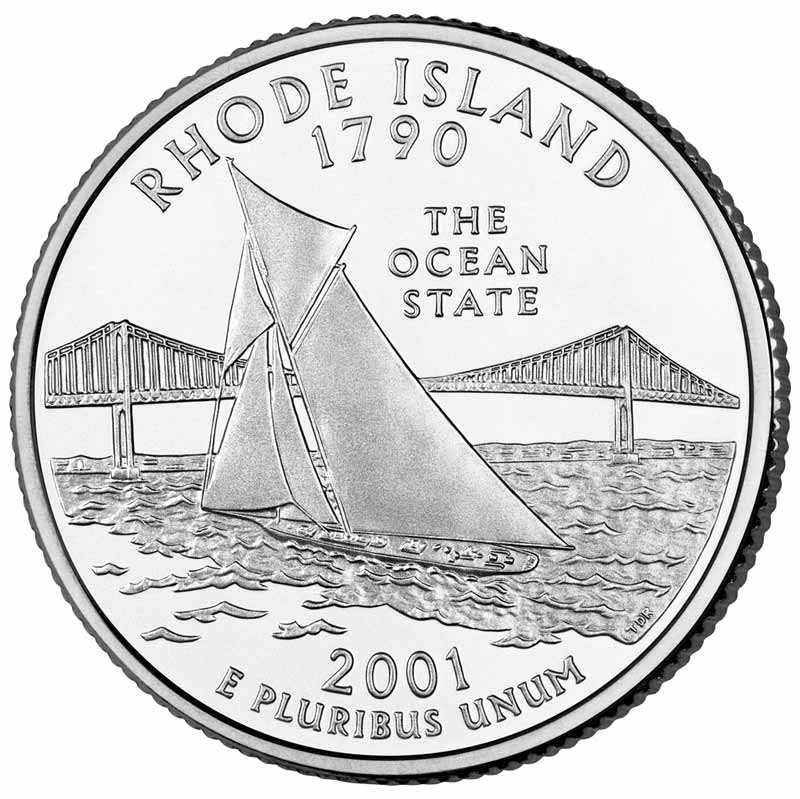

Rhode Island

-

South Carolina

-

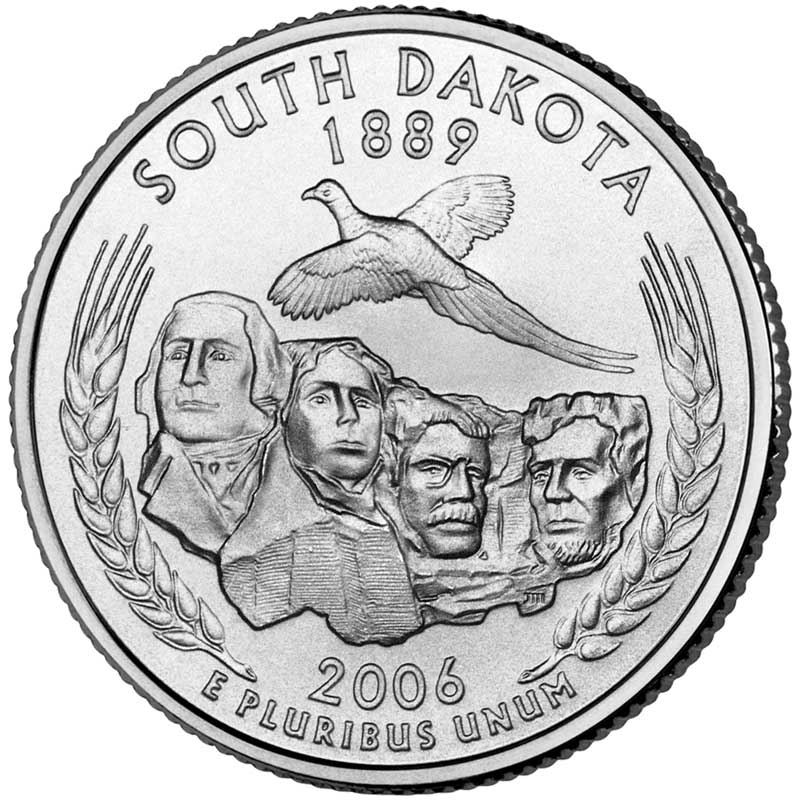

South Dakota

-

Tennessee

-

Texas

-

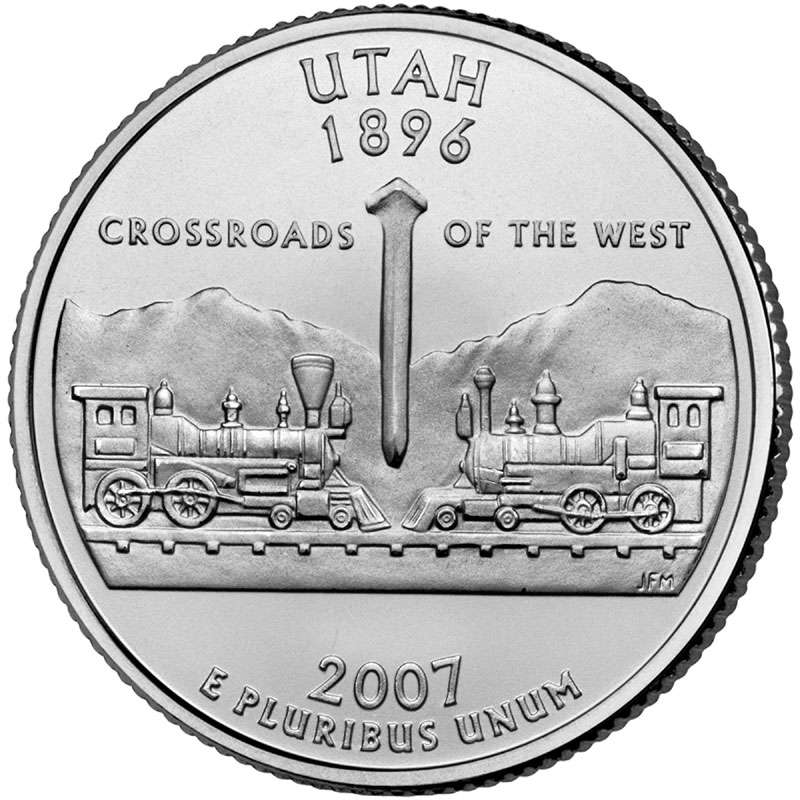

Utah

-

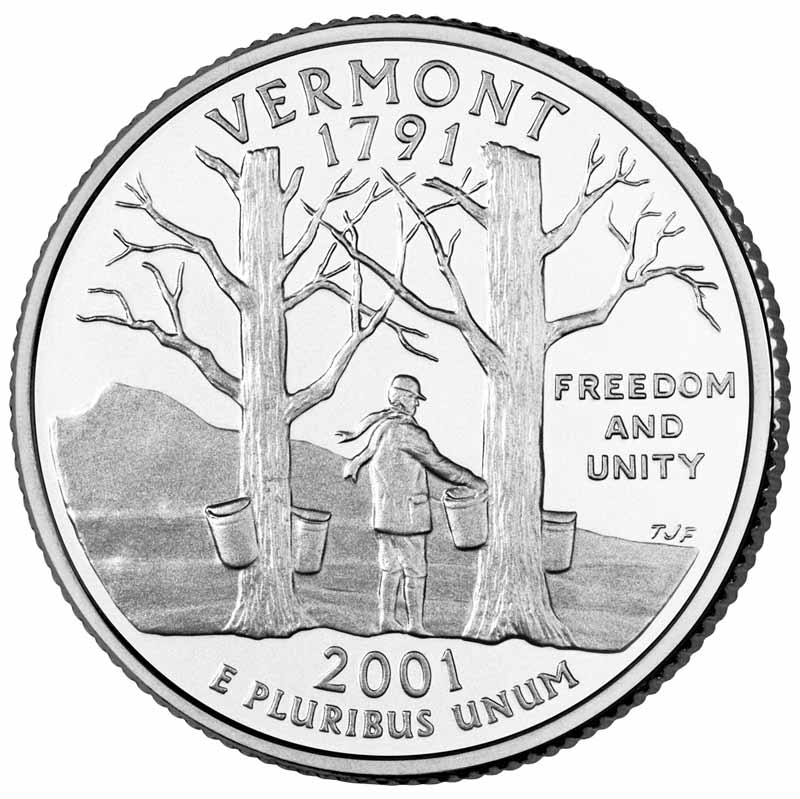

Vermont

-

Virginia

Organization:

Contact:

Legislation Links:

H.J.R. 62 (2010) Establishes a joint subcommittee to study whether to establish a bank operated by the Commonwealth. The study shall consider recommendations for legislation to establish a state owned, controlled, and operated bank. -

Washington

Organization:

Contact:

Legislation Links:

H.B. 3162 Creates a state bank overseen by the state treasurer. Allows the state treasurer to fund the bank with state funds. Provides the state bank with the same types of authority to operate as a private bank chartered by the state.

H.J.R. 4224 Proposes an amendment to the state constitution authorizing a state bank of Washington.

-

West Virginia

-

Wisconsin

-

Wyoming

-

Canada

Organization: Canada Chapter of the Public Banking Institute

Contact: Alan Blanes

Legislation Links: